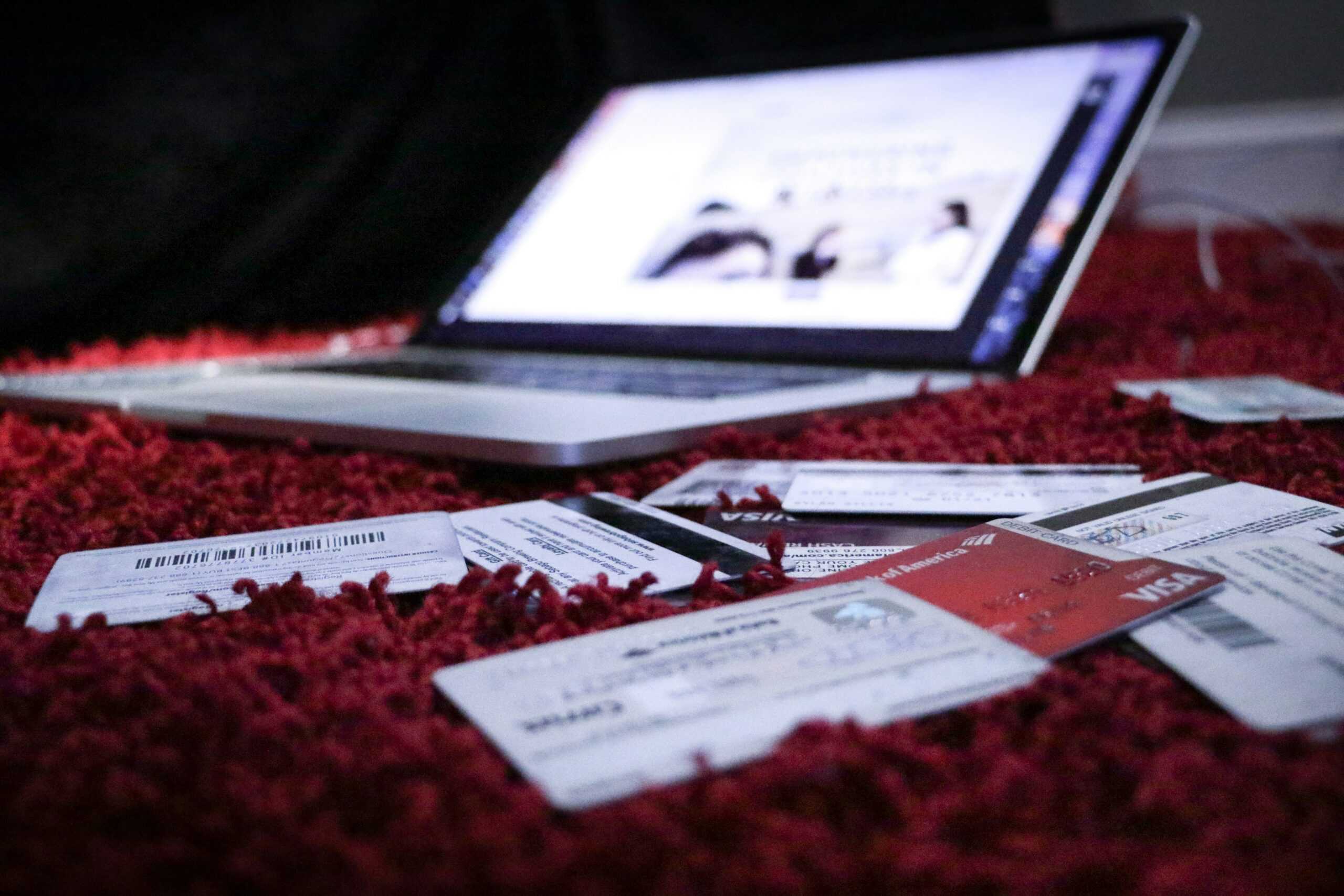

Unpaid debt claims arise when individuals or businesses fail to meet their financial obligations, leading to disputes or legal actions. Whether you’re a creditor seeking repayment or a debtor facing collection efforts, understanding your legal rights and obligations is essential. These claims can stem from various situations, such as overdue credit card payments, personal loans, or unpaid invoices. Successfully navigating unpaid debt issues requires a clear understanding of Ontario’s legal framework, including the Limitations Act, 2002 and the Collection and Debt Settlement Services Act.

If you’re dealing with unpaid debt issues, consulting with a legal professional like Daniel English can help ensure your case is handled with care and expertise. YLAW provides tailored support to guide you through the complexities of debt collection laws in Ontario.

At YLAW, we specialize in handling unpaid debt claims by offering tailored legal services to both individuals and businesses. Our team is dedicated to helping clients navigate the complexities of debt collection law, ensuring they understand their rights and legal options. Unpaid debt claims can involve various legal challenges, including proving the existence of the debt, demonstrating breach of contract, and establishing the amount owed. Whether you are a creditor seeking to recover funds or a debtor facing collection efforts, our paralegal services offer expert support throughout the process. We are committed to finding cost-effective solutions, often resolving disputes without the need for lengthy and expensive litigation.

For more information on debt collection and legal responsibilities in Ontario, we can guide you through the Limitations Act, 2002 and the Collection and Debt Settlement Services Act, which outline key legal standards for debt recovery, time limitations, and fair collection practices. We provide guidance on navigating these legal matters to help achieve the best possible resolution for your case, whether you’re seeking to recover funds or defend against collection efforts

Unpaid debt claims can arise from various situations where a party fails to meet their financial obligations, leading to disputes or legal actions. Some of the most common types of unpaid debt claims include:

Unpaid debt claims can have serious financial and legal consequences if not handled properly. Seeking professional legal advice ensures that individuals and businesses can address unpaid debt issues effectively and explore available options for resolution.

If you are involved in an unpaid debt claim, taking the right steps is crucial to ensuring a fair and efficient resolution. Here’s what you should do next:

Taking swift and informed action is key to achieving the best possible outcome. For professional assistance with your unpaid debt claim, don’t hesitate to contact us. We’re here to provide expert legal support and guide you through every step of the process, ensuring compliance with Ontario’s debt collection regulations.